One thing that many people new to investing or fumbling their way around the markets aren’t necessarily aware of are ‘Options’ which are a market derivative. You may have heard someone discussing derivatives on the news or in a movie when they are talking about their portfolio and having “stock options” but what are they?

Options can be a complicated beast however when you learn the basic ins and outs of them they are an awesome tool and something I personally love to trade. I am going to keep this discussion as simple as possible to give anyone new to options an appreciation what they are in a succinct manner. There are essentially two types of options; Call options and Put options.

You can either be a buyer of options or a seller of them. For now think of them like an insurance contract as at their core they are a contract between a buyer and seller. Each option contract controls a parcel of 100 shares.

CALL OPTION

A call option is a contract that gives the buyer of the

contract the right but not the obligation to purchase an amount of underlying

shares (100 per option contract) from the seller at a predetermined price

within a specified time frame.

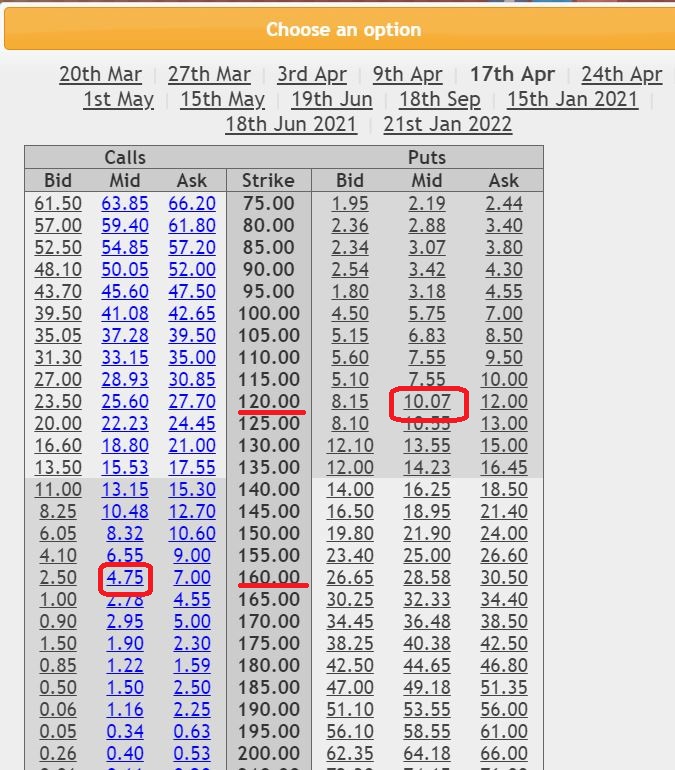

Example: (For demonstration purposes I’m using actual market data that was applicable at the time of writing)

Stock: Mcdonalds (MCD) trading at $137.30

Date: 19 March 2020

Andrew invests and trades in the stock market and the McDonalds share price recently has dropped significantly due to the Corona Virus Pandemic fear in the market. Andrew believes the market has over reacted and thinks within the next month McDonalds will trade near its usual price above $180. As a result Andrew does the following:

Andrew purchased from me (the seller) 1 Call option at

a strike price of $160 for $4.75 per share with an expiry of that option on 17th

April 2020. As each option contract controls 100 shares, Andrew has paid me

$475 in total. This gives Andrew the right (but not the obligation) to buy 100

McDonalds shares from me at the price of $160 on or before the 17th

of April 2020.

So from this example, regardless of where the share price goes I have made

$475.

If on expiry McDonalds trades under $160 the option contract expires worthless (‘Out

of the Money’) and Andrew has made no money on this.

Lets assume on the date of option expiry McDonalds trades at $180.00. The

option is now what’s called ‘In the Money’ so as a result Andrew exercises the

option contract and he purchases from me 100 McDonalds shares (that I already

owned).

Options are an excellent tool with great qualities

when used appropriately, let’s look at this example. Andrew was able to buy my

shares for $160 even though when he bought them from me (exercised option

contract) they were trading at $180. In effect Andrew immediately makes a

profit of $20 (per share). This has to be offset with the $4.75 per share he

paid me on purchase of the option.

Overall Andrew has made ($20 -$4.75) * 100 = $1525

In percentage terms Andrews return on investment is 320%

This is one of the beauties of Option contracts, for Andrew while he paid $475 he had no further downside risk should McDonalds shares drop further and on the other side of this trade Andrew made $1525 without outlaying the capital initially to buy 100 shares. This would have cost $13730 (137.30 * 100) which as you can see is capital intensive. Further to this, had Andrew made this trade by purchasing the shares instead his risk is significantly more should the share price keep falling.

PUT OPTION

A

put option is a contract that gives the buyer of the contract the right but not

the obligation to sell an amount of underlying shares (100 per option contract)

to the seller at a predetermined price within a specified time frame.

For this example, I will stick to McDonalds shares as

above. In this example let’s assume Andrew on this occasion already owns 100

McDonalds shares.

This month McDonalds was trading above $200 however had a rapid decline to

$137.30. Given the drastic reduction in price, I am interested in purchasing

100 McDonalds shares however only if the share price gets to $125. Now this

highlights another beautiful thing with options contracts. Most people in this

position would set a limit order with their broker to purchase 100 shares at $125

and should the share price reach that, then the order is triggered and you

purchase the shares for that price. Not me however, I’m going to do something

different and sell a Put option.

I sell to Andrew 1 Put option contract at a strike price of $125 for $10.07 per share with an expiry of that option on 17th April 2020. As each option contract controls 100 shares, Andrew has paid me $1007 in total. This gives Andrew the right (but not the obligation) to sell his 100 McDonalds shares on or before the 17th of April 2020 to me for $125.

So from this example, regardless of where the share

price goes I have made $1007. This blows the mind of some people new to this. How

is it I can make money from McDonalds shares when I don’t even own them. This

is the beauty of options, however understand there are risks.

Why would Andrew buy a put option in the first place? There are a number of

reasons however a primary reason in this case could be to protect his

investment and guarantee that regardless of where the share price goes (ie

significantly lower) he has locked in a sell price of $125 that I am obligated

to buy them at. So you can see as a seller I take on a level of risk and I have

to have the cash available to purchase 100 shares at that price.

Let’s assume on the date of option expiry McDonalds trades at $115. The put option is now what’s called ‘In the Money’ so as a result Andrew exercises the option contract and he sells me his 100 McDonalds shares for $125. Now this may be disconcerting for some to have to buy shares at $125 each when they have dropped under that and now I’m at a loss of $10 per share. Remember the limit order would have purchased the shares for you at that price too. Hang on a moment however, remember I sold the put option for $1007. So in effect my breakeven price on the shares is $114.93.

On option expiry if McDonalds traded above the strike price of $125, then the option is ‘Out of the Money’ and expires worthless. So I don’t get to own the shares on this occasion however I can sell another put option for the next month and continue to make income from shares I don’t own.

Conclusion

In my previous blog post, Market Trading, I

mentioned trading the markets is a zero sum game however utilising alternative

instruments we can participate in trades that are not zero sum. It is estimated

that of traded options in the market, approximately 80% of them will expire

worthless. So there is a distinct advantage to being a seller as in general

from that statistic there is an 80% chance of any options sold will expire

worthless. Remember in the beginning of this post I said to think of options

like an insurance contract. So as the buyer of insurance the contract is there

for protection and you don’t necessarily want to have to exercise the contract.

This is excellent as a seller, you can earn premiums from the market, however

understand that as the seller of options you take on risk and this risk at

times can be significant and detrimental to your portfolio if you’re not well

versed with the inherent qualities of options.

In both examples above where I have made myself the seller, I have taken on risk. There are ways I can mitigate or reduce that risk which hasn’t been covered adequately in this article.

Of note, in the example above, I used real market prices. The premiums for the option contract described above are higher than normal due to the widespread market panic. Currently with Covid 19 (Corona Virus) the market has collapsed and just like regular insurance premiums when there is increased risk or fear, the options contracts are trading higher.

In closing, understanding Options and how to use them

either as a buyer or seller is a useful tool to have in your trading arsenal. A

lot of people see options as complex and risky instruments (which they

definitely can be). A person who owns shares outright actually takes on more

risk. The examples above show how as both the buyer and seller of the options there

is less risk than trading the 100 McDonalds shares outright.

Given options are a fascinating beast and most people aren’t aware of what they

are all about, I am happy to answer any of your queries. Please do not take the

above as advice as its for illustrative purposes only in explaining how Call

and Put options work. There is so much more to learn in relation to options and

this is barely an introduction to them.

Let’s Talk

Shoot me a message, I’d love to talk to you about how we can help you on your financial freedom journey.